WASHINGTON, May 22, 2025 (GLOBE NEWSWIRE) --

- FORECAST: A slight contraction in new business volumes suggests a 0.4% decline in new durable goods orders in April.

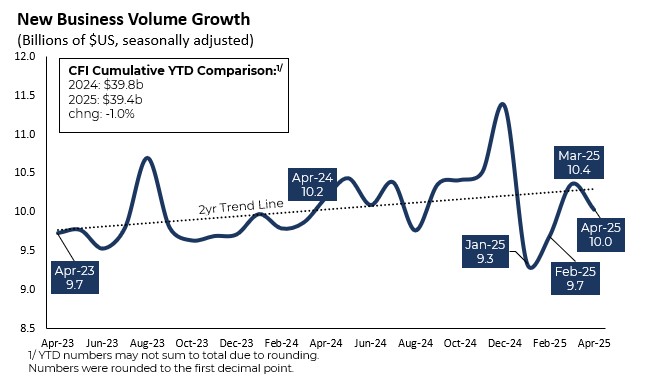

- Total new business volume (NBV) rose by $10 billion seasonally adjusted among surveyed ELFA member companies, a decrease of 3.2% from the prior month.

- NBV year-to-date contracted by 1.0% relative to the same period in 2024.

- Year-over-year, NBV dropped by 4.4% on a non-seasonally adjusted basis.

- Charge-offs (losses) declined to 0.40%, the largest single-month decrease since October of 2020.

“The April CFI showed a sector that weathered the recent surge in economic and financial market volatility. Demand for new equipment eased a little, but remained healthy, especially given all the April ups-and-downs,” said Leigh Lytle, President and CEO at ELFA. “Financial conditions strengthened remarkably, with losses and delinquencies plummeting. The across-the-board improvement in charge-offs highlights the industry’s resiliency, while the reduction in delinquencies suggests more improvements in financial conditions are on the horizon. Even if some of the impact from changing trade policy is delayed, the strength in financial conditions shows that it will take a lot more than uncertainty to knock the industry off course. While I don’t expect calm waters over the remainder of the year, I am optimistic that uncertainty will ease, which suggests a strong second half of the year for our industry.”

New business volumes edged lower. New business volume growth cooled in April, declining 3.2% from the prior month. The $10 billion in overall new business volume is the second highest reading in 2025 and remained close to its two-year trend. Activity at banks and captives declined by 6.1% and 10.4%, respectively, while new volumes grew by 0.1% at independents. Over the last five months, the equipment finance industry has experienced an uptick in demand volatility, much of it in new business volumes at banks, which make up roughly half of the CapEx Finance Index. Even with the slowdown in new activity at banks, the average monthly rate of new business volumes was $5.1 billion over the first four months of the year, which is in line with the average over the last six months of 2024. New volume growth for small ticket deals dropped by 18.3% to $2.8 billion. Year-to-date, the small ticket index is down 20.6%, and the average monthly volume of new business remains well below its 2024 average.

The pace of job losses slowed. Employment in the equipment finance industry was down 2.0% over the previous 12 months. That’s a slower rate of contraction than the 2.7% yearly decline in March. Employment at banks and captives both declined, while headcount at independents increased.

Credit approvals shot up to the highest rate in over two years. The overall credit approval rate jumped to 77.4%, a rise of almost 1.4 percentage points. That is double the 0.7 percentage point increase in the prior month. The overall credit approval rate has so far risen by 3.1 percentage points in 2025.

Financial conditions strengthened markedly. Aging receivables over 30 days fell by over 40 basis points to 1.8% in April. That is the lowest delinquency rate since June of 2023, and the biggest decline since November of that same year. Delinquencies on small ticket deals dropped by 34 basis points, and rates at banks and independents declined. Aging receivables at captives erased a March decrease, rising to 2.5%. After climbing for two months, the overall charge-off rate dropped to its lowest point since October last year. The loss rate on small ticket acquisitions also declined, as did the charge-off rate for banks, captives and independents.

“We are cautiously optimistic about the months ahead and the stability of the economy and our industry as we head into summer,” said Daryn Lecy, CLFP, SVP/Chief Operating Officer, Oakmont Capital Services. “There are macroeconomic reasons to wait and see, as negotiations on tariffs begin and will likely take time. Additionally, several significant economic reports are set to be released in the coming weeks, which may impact business and consumer confidence. Specific to our industry, recent positive data—such as strong credit approvals—aligns well with substantially improved month-over-month delinquency and loss figures, giving us further reasons for optimism. Our industry is comprised of talented individuals and creative problem solvers who will adapt and position themselves to secure opportunities in any economic conditions.”

Industry Confidence

The Monthly Confidence Index from ELFA’s affiliate, the Equipment Leasing & Finance Foundation, increased to 44.5 in May, up from 41.9 in April, as equipment finance companies await further clarity around tariff policies.

About ELFA’s CFI

The CapEx Finance Index (CFI) is the only real-time dataset that tracks nationwide conditions in the equipment financing industry. The information is compiled from a diversified set of businesses that respond to questions about demand for equipment financing, employment, and changes in financial conditions. The resulting data is organized by institution type, such as banks, captives, and independents, and is classified into overall activity and financing for small ticket equipment and software. The CFI is released monthly from Washington, D.C., generally one day before the U.S. Department of Commerce's durable goods report. More detail on the data and methodology can be found at www.elfaonline.org/CFI.

About ELFA

The Equipment Leasing and Finance Association (ELFA) represents financial services companies and manufacturers in the $1 trillion U.S. equipment finance sector. ELFA’s over 600 member companies provide essential financing that helps businesses acquire the equipment they need to operate and grow. Learn how equipment finance contributes to businesses’ success, U.S. economic growth, manufacturing and jobs at www.elfaonline.org.

Follow ELFA:

X: @ELFAonline

LinkedIn: https://www.linkedin.com/company/115191

Media/Press Contact: Krishna Magalona, PR Manager, ELFA, Krishna@360livemedia.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b4b94a8a-22d2-45f2-a618-8c1d5c73620e